The Ranch, Issue 11

Updates on our work with Aave, Gitcoin, and Friends with Benefits. Plus - a deep dive on how Llama uses Dune for on-chain reporting.

Welcome to The Ranch, Llama’s Substack newsletter.

In this publication, we’ll share quick and easy to digest insights on:

Updates from Llama 🦙

Herd on the Street - interesting insights on DAOs

Opportunities - ways you can get involved with Llama

1. Updates from Llama 🦙

Aave

Our on-chain proposal to consolidate Aave’s Reserve Factors and re-enable the borrowing of DPI passed unanimously last week.

Next, Llama has written the code for our next on-chain proposal to add the CVX token to the protocol. We’re currently awaiting code review from the Aave team, after which we’ll put the proposal up for an on-chain vote.

Gitcoin

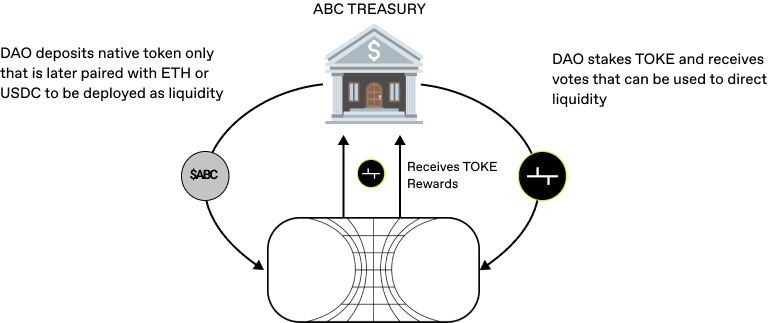

Llama shared its proposal for Gitcoin to secure a Tokemak reactor through Tokemak’s C.o.R.E. 4 process. In Tokemak’s Collateralization of Reactors Event, protocols compete with one another to earn one of five reactors that’s up for grabs.

Should Gitcoin win a Tokemak reactor for GTC, they’ll be able to create deep and sustainable liquidity for the token. Further, Gitcoin can earn revenue or governance power in the form of TOKE, which is distributed to Liquidity Providers on the Tokemak platform. Gitcoin also won’t need to provide ETH or USDC to bootstrap the pool.

We provide more detail in our proposal, but the basic steps required for Gitcoin to use Tokemak are:

Gitcoin wins C.o.R.E. 4 and creates a Tokemak reactor.

Gitcoin deposits GTC in the reactor in exchange for tGTC.

This tGTC can only be withdrawn at the end of the cycle [2]. However, smaller depositors in the pool will be able to swap tGTC for regular GTC at any time on a normal DEX (assuming a liquidity pool is created).

Gitcoin will earn TOKE, which it can stake and then use to 1) direct TOKE rewards to the pool and 2) direct GTC liquidity to different exchanges.

Other TOKE holders (Liquidity Directors) are incentivized to direct GTC liquidity to the appropriate exchanges.

Friends with Benefits

In our last issue of The Ranch, we highlighted our Liquidity Improvement Plan for the FWB token. In short, our plan involves a permissioned escrow contract that allows Llama to direct FWB tokens to an Active Liquidity Management strategy (in this case, Gamma Strategies) to handle the LP position on Uniswap v3.

Since then, Llama has finished development of the escrow contract and had the code reviewed by developers in the Friends with Benefits community.

2. Herd on the Street

Insights and articles from the DAO world, curated by our herd.

Deeper Data, Dune and Beyond: On-chain Analytics with Llama - @scottincrypto

As one of Llama’s most active data wizards, Scott has been involved with a number of reporting projects across several DAOs. Here, he delves into how Llama uses and goes beyond Dune to power our financial and protocol reporting.

New Foundry Release: Solidity Scripting & Deployments

Foundry is a toolkit for Ethereum application development and includes Forge, an Ethereum testing framework. Scripting & Deployments take Foundry beyond a testing framework and make it valuable for ChainOps.

3. Opportunities

Are you interested in researching and designing novel, crypto-native economic mechanisms? We’d love to chat - let us know in this form!

Stay Up to Date on Llama 🦙

Follow us on Twitter, check out our website, and read our writing on Mirror.