The Ranch, Issue 7

Updates on our work with Aave, dYdX, and PoolTogether. Gradual Dutch Auctions & standardized governance proposals.

Welcome to The Ranch, Llama’s Substack newsletter.

In this publication, we’ll share quick and easy to digest insights on:

Updates from Llama 🦙

Herd on the Street - interesting insights on DAOs

Opportunities - ways you can get involved with Llama

1. Updates from Llama 🦙

In case you missed it, check out our latest Mirror post, DAOlitical Parties and DAOliticians, authored by 0xkydo. Kydo explores the future of metagovernance and how special interest groups might form around different agendas.

We welcomed three new llamas to the community! In the last edition of The Ranch, we featured an article assessing the fairness of the Fei <> Rari deal from Jordan Stastny and Sam Bronstein. We’re excited to have both Jordan and Sam as new Llama community members, bringing with them a wealth of banking and M&A experience.

We’re also excited to have Chris Longden on board to help with our new dYdX project (more details below)! Chris will help out by creating the visualizations and dashboards for the project.

Aave

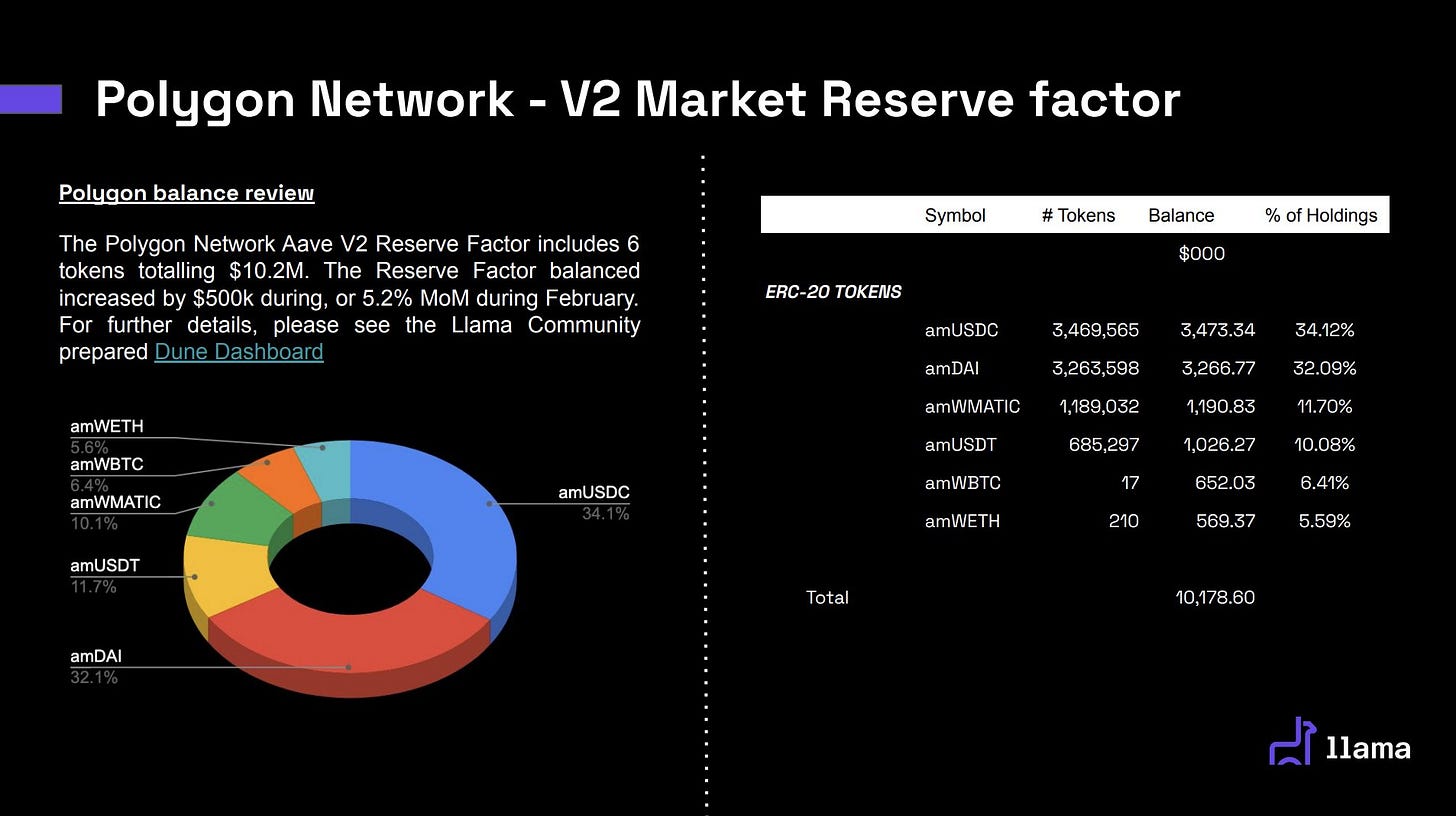

This week, we published February 2022 financials for Aave.

Given poor market performance across the DeFi ecosystem, February proved a challenging month for the protocol. Aave saw declines in revenue from both markets we currently track (mainnet & Polygon).

Aave’s V1, V2, and AMM Reserve Factors are well-diversified (>50% in stables). Llama has proposed using these reserves to generate yield and boost Aave’s metagovernance power through purchases of CVX, CRV, and BAL.

Questions or comments on our reporting? Please reach out to Elliott on Twitter!

dYdX

We’re excited to work with dYdX to build analytics dashboards to help the community evaluate activity on the dYdX platform. We’ll help identify key drivers of changes in trading volume, user activity, and protocol revenue. We’ll also assess if those key drivers can be used to increase trading activities.

Our analytics will also help assess the impact of key product launches, trading incentives, and executed community proposals.

PoolTogether

The PoolTogether community recently renewed the PoolTogether Treasury Working Group (TWG) for a second quarter. In the group’s second operational quarter, our very own BraveNewDeFi will serve as chair of the working group. Llama Yuan Han Li will also continue to contribute to the working group.

In its first quarter, PoolTogether’s TWG reviewed options for stablecoin asset management and proposed PTIP: 54: Treasury Assets Management #1, which added productive assets to the treasury and started the use of USDC to generate interest for prizes in PoolTogether V4. The group also provided an analysis of the Ondo <> Fei Liquidity as a Service program. For more details on TWG’s first quarter deliverables, see this post on PoolTogether’s forum.

In its second quarter, the working group plans to:

Evaluate PT’s use of the Ondo <> Fei LaaS program

Identify new yield sources

Work on prize-tiering

Explore non-stablecoin asset management

Evaluate TRIBE Turbo

Leverage time-weighted average balance (TWAB) for protocol growth.

2. Herd on the Street

Insights and articles from the DAO world, curated by our herd.

Gradual Dutch Auctions - Paradigm

Paradigm introduces the Gradual Dutch Auction (GDA), a mechanism for efficiently selling assets without liquid markets (NFTs, for example). Paradigm’s researchers explore both continuous and discrete GDAs and the use cases for each.

Proposed Template for Future Cross-chain Deployment Proposals - Uniswap Labs

As protocols grow and become multi-chain, governance can quickly become complex and inefficient. Here, Uniswap offers a standard template for community members wishing to deploy Uniswap V3 to other chains which will help fast-track the governance process.

3. Opportunities

We're still looking for talented artists and graphic designers 🖌 to help us with graphics for social media and blog posts. If you fit the bill, let us know in this form!

Stay Up to Date on Llama 🦙

Follow us on Twitter, check out our website, and read our writing on Mirror.